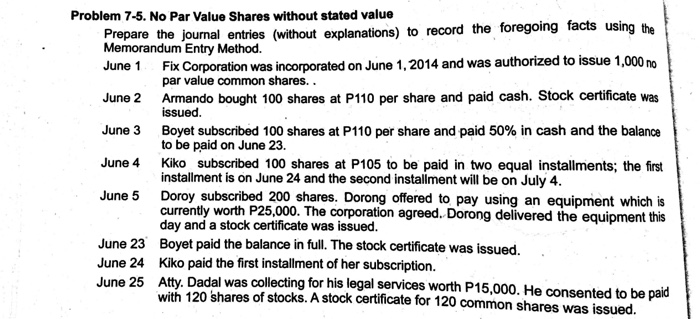

What Is No Par Value Shares

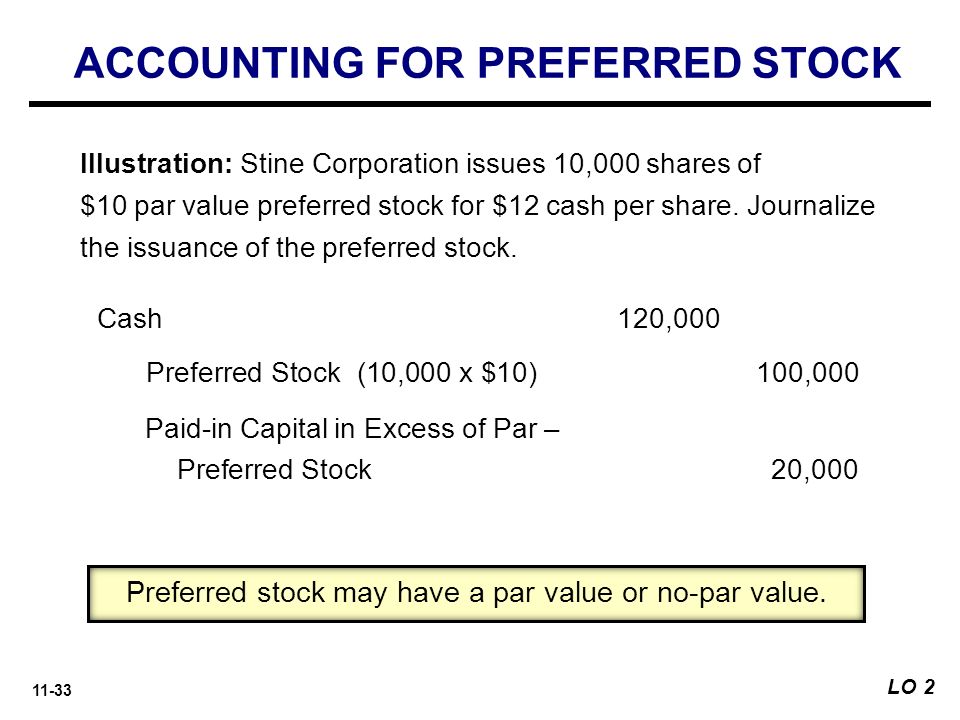

The issuing company promises not to issue further shares below par value so investors can be confident that no one else will receive a more favorable issue price.

What is no par value shares. Par value stock. The par value of a share is the value stated in the corporate charter below which shares of that class cannot be sold upon initial offering. Companies sell stock as a means of generating equity capital so the par value multiplied by the total number of shares issued is the minimum amount of capital that will be. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time.

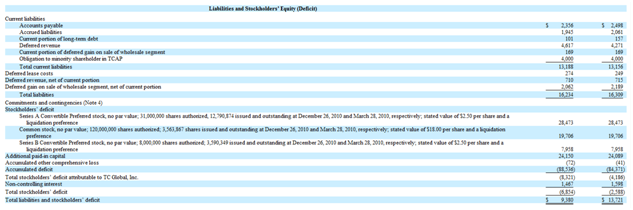

After the implementation date of the companies act a pre existing company may not authorise any new par value shares authorise any shares having a nominal value or do any subdivision thereof. The board must determine the price or other adequate considerations at which shares may be issued. Low par value stock. No par value stocks are printed with no face value designation while low par value stocks may show an amount lower than 0 01 or up to a few dollars.

What is par value of share. There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the.