Shares With No Par Value

What is par value of share.

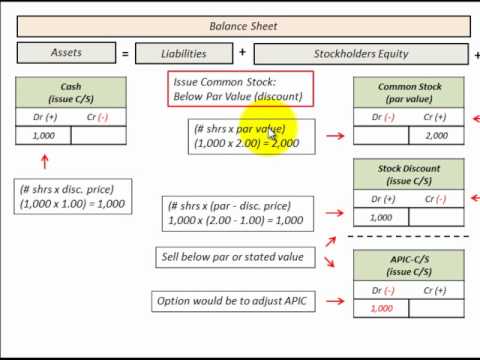

Shares with no par value. A no par value stock is issued without the specification of a par value indicated in the company s articles of incorporation or on the stock certificate itself. When the relevant provisions of the bill including clause 74 come into effect the abolition of par value will apply to all shares of malaysian incorporated companies including those issued prior to that. Share issued with no par value specified either on the share certificate or in the issuer firm s charter or prospectus. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares.

No par value npv share. Under a no par value regime a company will have more flexibility in pricing its shares and raising capital as the restrictions on discounts to par value for new shares will no longer apply. There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the. The objectives of its issuance include 1 avoidance of taxes levied according to the share s face value 2 avoidance of the issuer firm s liability to shareholders in the event the shares have to.

No par value stocks are printed with no face value designation while low par value stocks may show an amount lower than 0 01 or up to a few dollars.