No Par Value Vs Par Value Shares

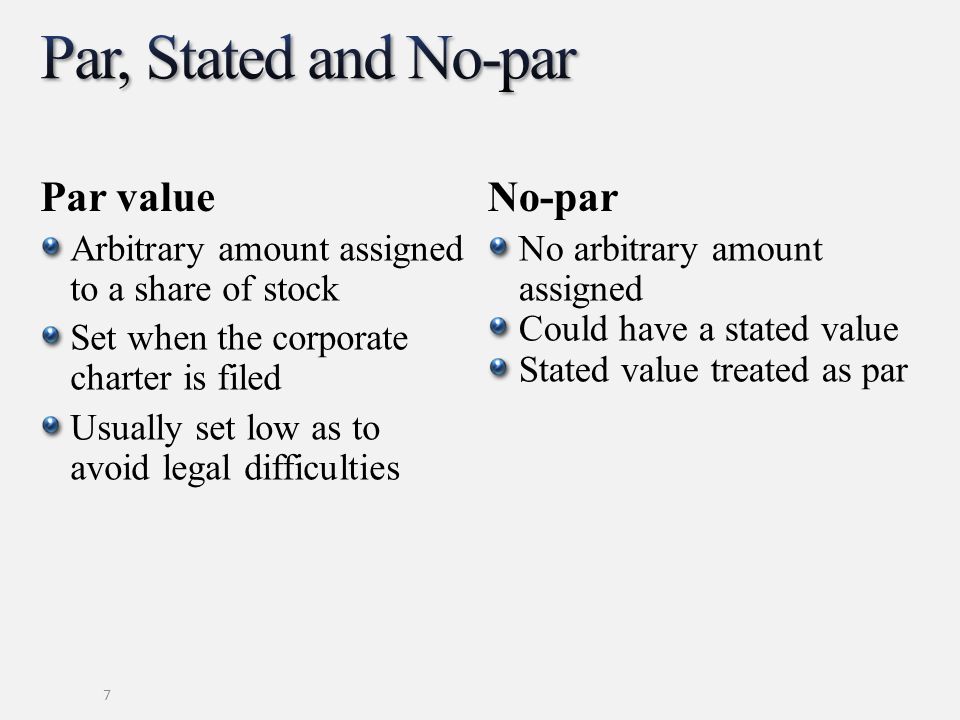

Par value is the value stated in the corporate charter where it sets the minimum amount shares of similar class can be sold during its initial offering.

No par value vs par value shares. What is par value of share. So the par value on common stock is a legal consideration. In case of no par value stock you cannot find an explicitly stated par value on share certificate balance sheet or corporate charter. The issuing company promises not to issue further.

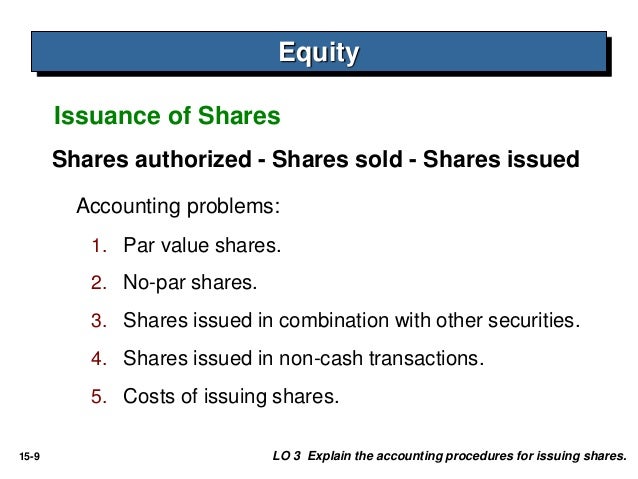

A par value stock unlike a no par value stock has a minimum value per share set by the company that issues it. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. For example if a corporation issues 100 new shares of its common stock for a total of 2 000 and the. In simple english means the issuing company promises not to issue more shares below a defined value this defined value is termed as par value so that investors can be confident that no one else will receive a more favorable issue price.

A no par value stock is issued without the specification of a par value indicated in the company s articles of incorporation or on the stock certificate itself. The stock or share to which the company does not assign any par value is known as no par value stock or no par value share. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. No par value stock.

There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the. The par value of a share is the value stated in the corporate charter below which shares of that class cannot be sold upon initial offering. Although the fluctuating market price of stocks has no effect on the books par value has a legal bind on part of the company to its investors no shares will be sold below that price. Some states in usa allow companies to issue stock without a par value.

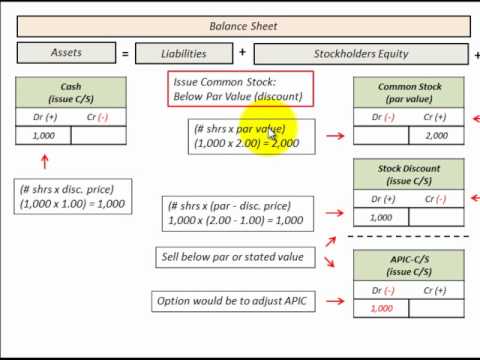

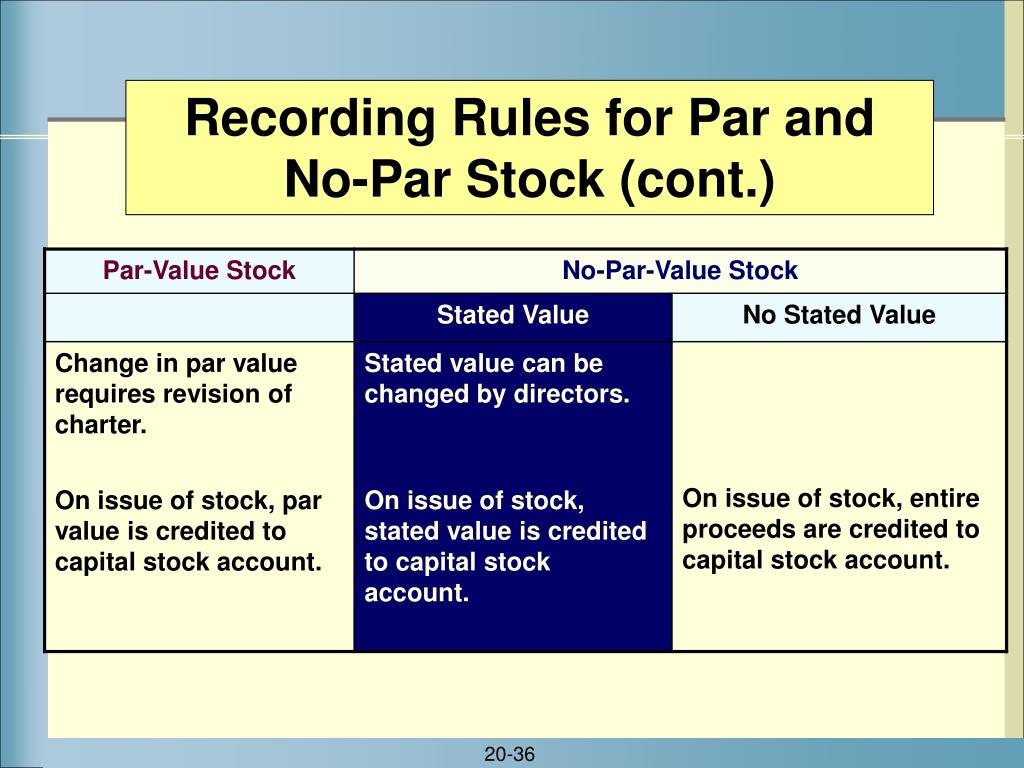

From an accounting standpoint the par value of an issued share of common stock must be recorded in an account separate from the amount received over and above the amount of par value.