No Par Value Shares New Companies Act Malaysia

Under the old companies act 1965 shares are issued with a par or nominal value and companies are required to declare authorised share capital.

No par value shares new companies act malaysia. No par value stocks are printed with no face value designation while low par value stocks may show an amount lower than 0 01 or up to a few dollars. Change in company law. Now the share premium will be dispensed with and a 24 month transition period given to companies to utilise their outstanding credit in their share. In the case of a company incorporated before the date of commencement of section 3 of the companies amendment act 2014 the memorandum of association of the company.

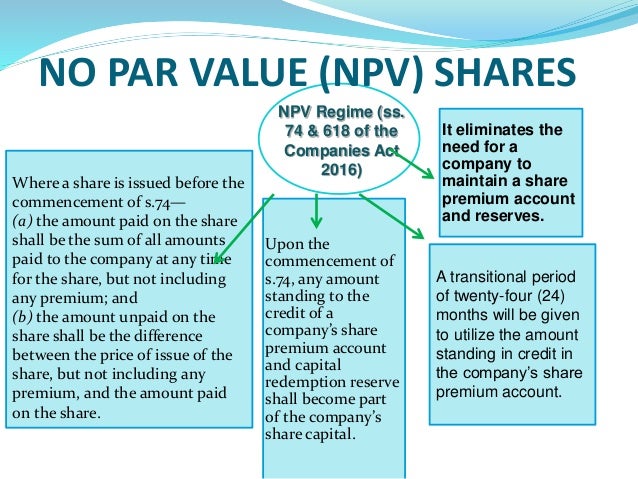

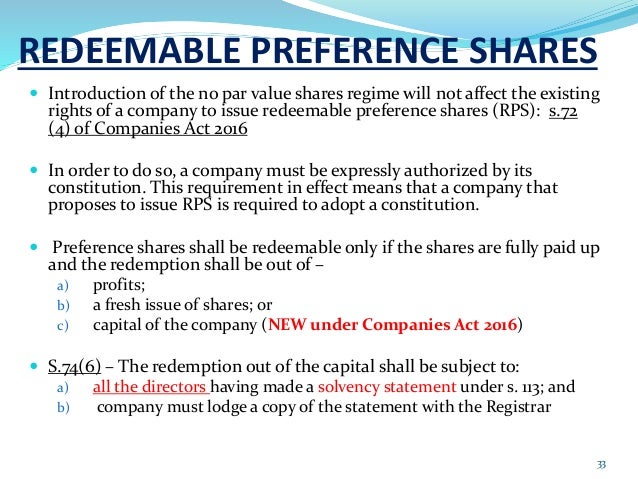

When the new companies bill 2015 the bill comes into effect it will abolish the concept of par or nominal value of shares that currently applies under the companies act 1965 par value represents the minimum price at which shares can be issued. It is also a restatement of existing rules. The new act abolishes this concept. The act section 74 introduces the no par value regime where shares of a company shall have no par or nominal value.

With effect from 31 january 2017 all companies with share capital migrated to no par value regime. Enacts fundamentally significant changes to company law in malaysia. Under the new companies act 2016 which is now in force a new regime has been introduced for share capital to be issued without par value. Shares of malaysian companies are currently issued with a par nominal value.

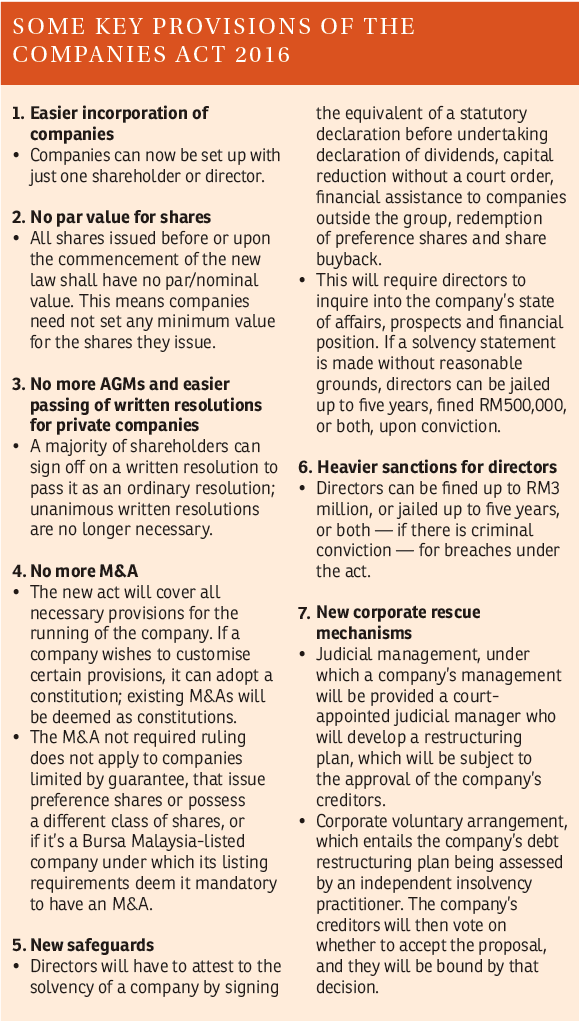

It introduces new concepts in relation to incorporation capital allocation decisions secured creditors rights reporting requirements corporate governance and rescue mechanisms. Par value is the minimum price at which shares can be issued. To ensure a smooth transition the bill provides for transitional. Section 74 ca 2016 reads all shares issued before or upon the commencement of this act shall have no par or nominal value.

Companies act 2016. The transition to a no par value regime is in line with international trends and has been widely accepted in other countries such as australia. Where a share is issued before the commencement of section 74 the amount. 62a no par value shares.

It is immaterial that the company was incorporated under the ca 1965 or any previous enactment. The bill introduces a no par value regime where all new shares issued by a company shall have no par nominal value. No par value regime the current companies act 1965 requires malaysian companies to issue shares with a par value or nominal value. No par value for shares.

Par value stock. 67 use of share capital to pay expenses incurred in issue of new shares. Low par value stock. One of the key changes in the recently passed companies bill 2015 is on par value of shares.