No Par Value Shares Meaning

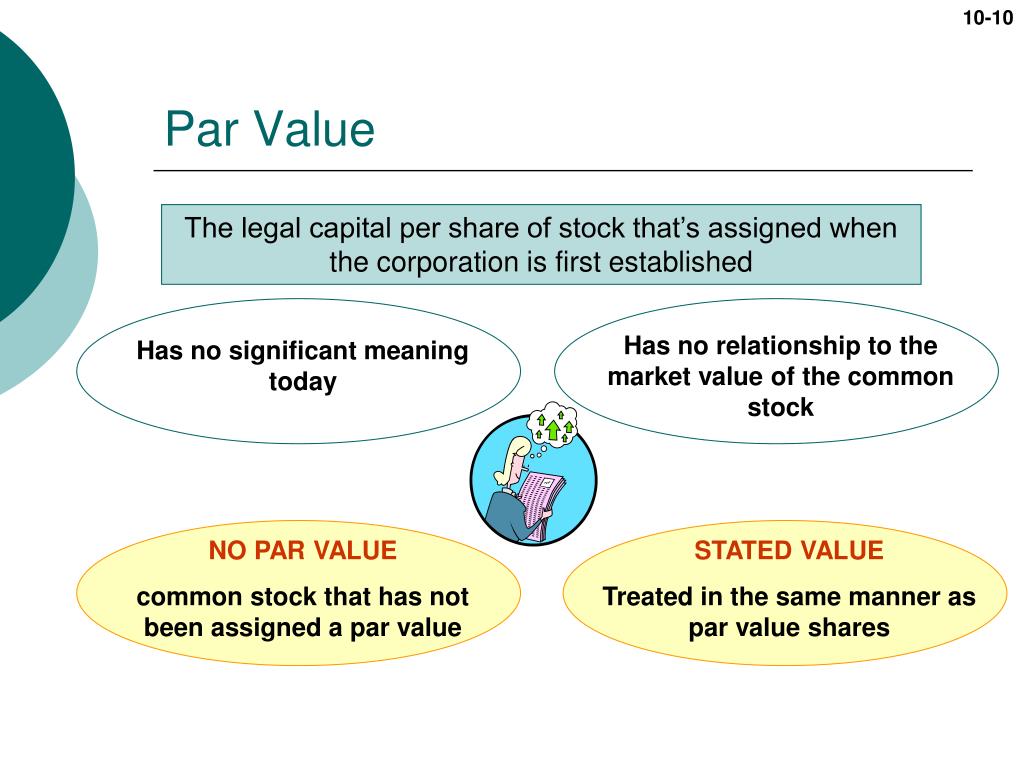

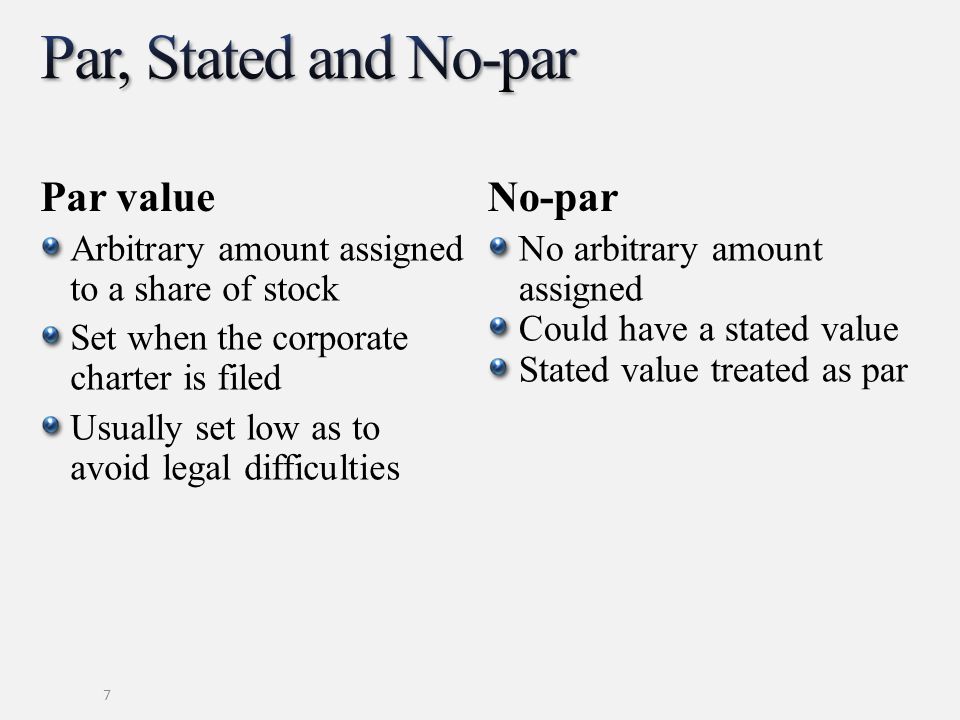

The par value of a share is the value stated in the corporate charter below which shares of that class cannot be sold upon initial offering.

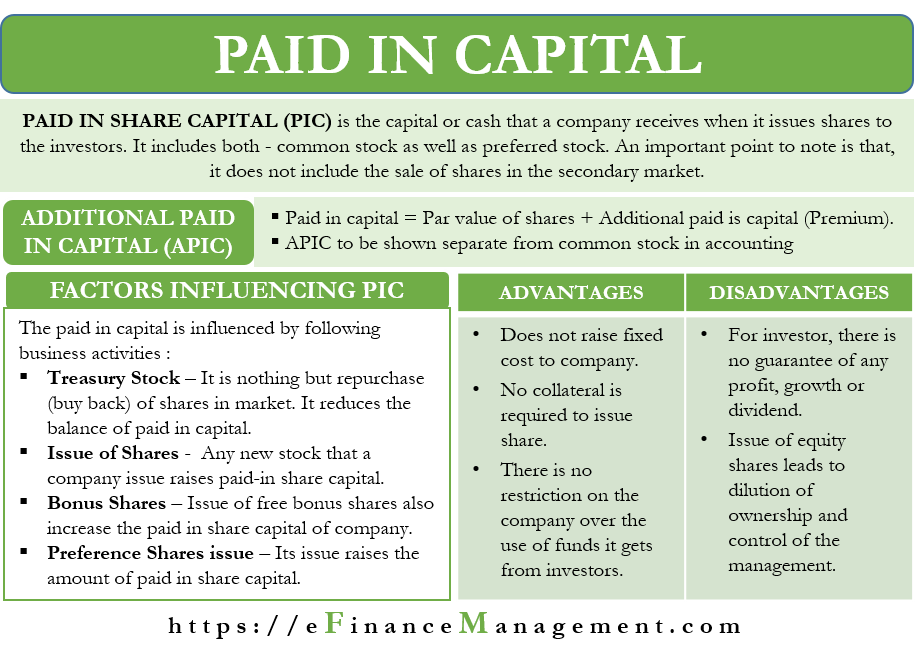

No par value shares meaning. That means issuing new shares at a discount to its par value is no longer an issue. The objectives of its issuance include 1 avoidance of taxes levied according to the share s face value 2 avoidance of the issuer firm s liability to shareholders in the event the shares have to. Instead the directors now have the discretion and the duty to determine an appropriate value for the shares when they are issued. Companies registered before 1 st of may 2011 with par value shares may still keep the par value until a special resolution is passed to convert it to no par value.

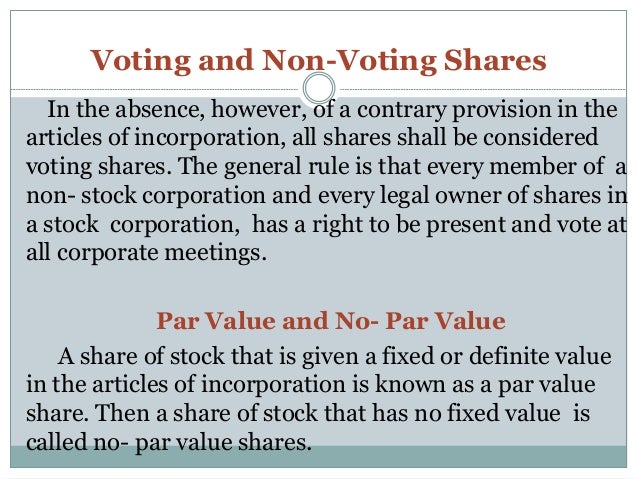

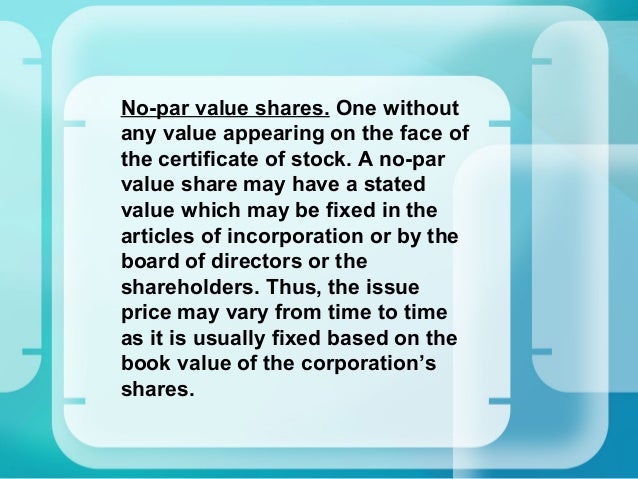

No par value means that there is no standard value attached to the shares. What is par value of share. The issuing company promises not to issue further shares below par value so investors can be confident that no one else will receive a more favorable issue price. Share issued with no par value specified either on the share certificate or in the issuer firm s charter or prospectus.

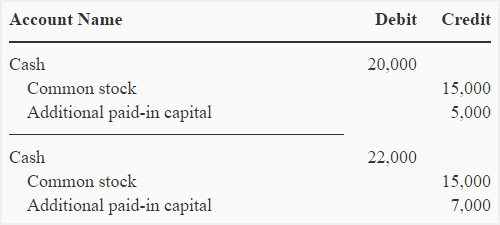

This has no relevance to the value of either in the market. No par value stock sometimes called no par stock is a class of stock that was never assigned a par value or stated value. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. A no par value stock is issued without the specification of a par value indicated in the company s articles of incorporation or on the stock certificate itself.

As the no par value regime comes into effect the concept of par value no longer applies. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares. Normally when a business is incorporated the corporate charter assigns a par value or base value for every share that will be issued. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time.

No par value npv share. A par value is a nominal or face value given to a share in the stock of a company authorized by its charter. In the past companies issued shares with significant par values such as 10 00 per share leading to confusion between this arbitrarily assigned amount and the actual market value of the shares with which it has no link. No par stock is stock issued without a par value.

/GettyImages-1058454392-146fd62a8b20476fa0888ecfa18868ae.jpg)

:max_bytes(150000):strip_icc()/why-boomers-should-rebalance-their-401ks-right-now-ts-5bfc2b5646e0fb005119a822.jpg)