No Par Value Share Type

Although prohibited in many countries the issuance of no par value stock is allowed in some states of usa.

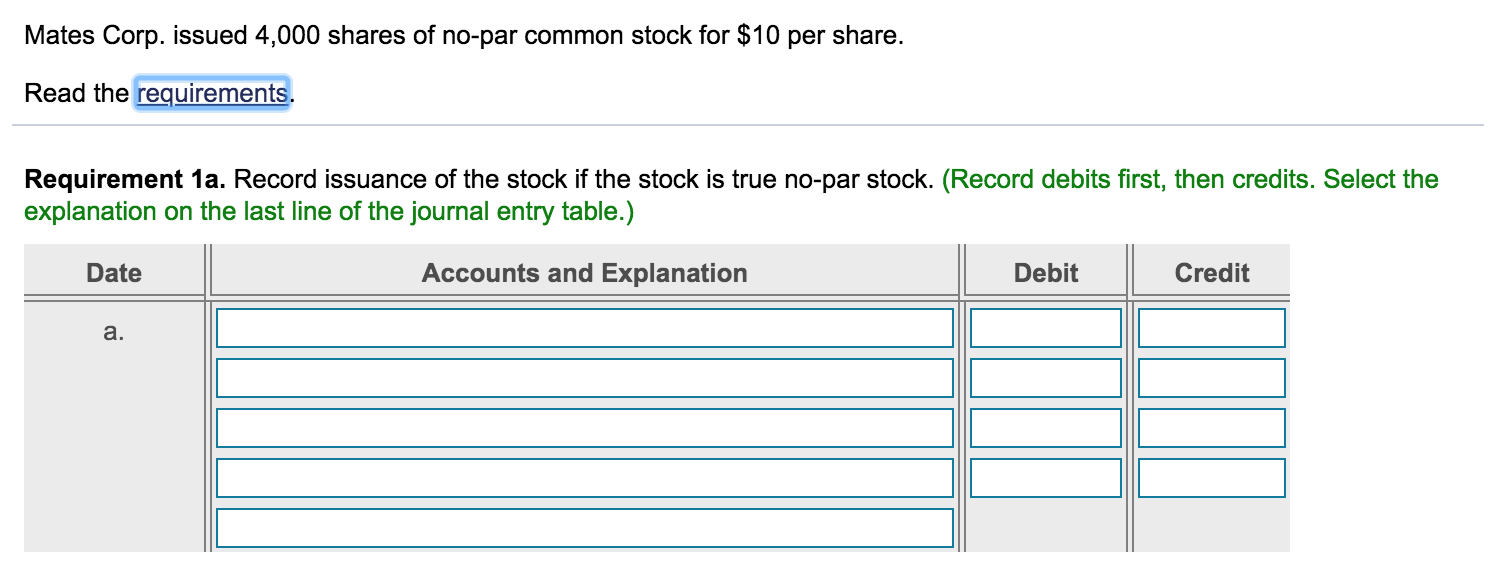

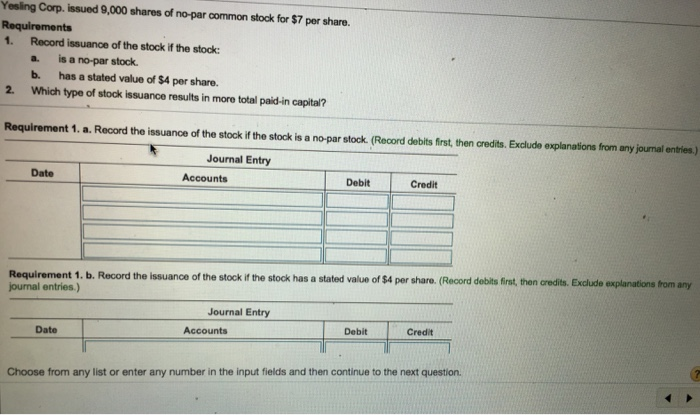

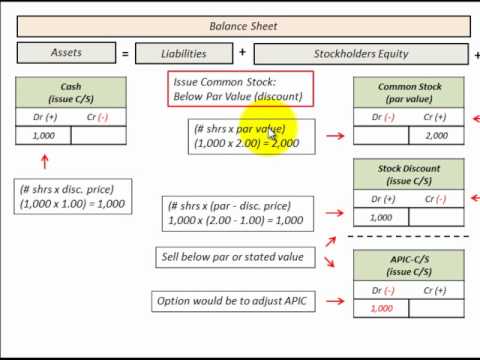

No par value share type. However par value is now usually set at a minimal amount such as 0 01 per share since some state laws still require that a company cannot. Journal entry for issuing no par value stock. A bond s par value is the dollar amount indicated on the certificate wherein the calculation of interest and the actual amount to be paid to lenders at maturity date is set. The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value.

This has no relevance to the value of either in the market. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares. No par value npv share. The share capital of a company is made up of the funds contributed by shareholders to the company in exchange for their shares in the company.

No par value stock as the name implies is a type of stock that does not have a par value attached to each of its share unlike par value stock no par value stock certificate does not have a per share value printed on it. Share issued with no par value specified either on the share certificate or in the issuer firm s charter or prospectus. Shares issued in terms of the 2008 act have no nominal or par value. No par value stocks are printed with no face value designation while low par value stocks may show an amount lower than 0 01 or up to a few dollars.

The new companies act 2008 has changed the basis on which companies are capitalised. Par value is the stock price stated in a corporation s charter. Low par value stock. The par value of a share is the value stated in the corporate charter below which shares of that class cannot be sold upon initial offering.

The objectives of its issuance include 1 avoidance of taxes levied according to the share s face value 2 avoidance of the issuer firm s liability to shareholders in the event the shares have to. The issuing company promises not to issue further shares below par value so investors can be confident that no one else will receive a more favorable issue price. Par value for stock.

:max_bytes(150000):strip_icc()/why-boomers-should-rebalance-their-401ks-right-now-ts-5bfc2b5646e0fb005119a822.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1058454392-146fd62a8b20476fa0888ecfa18868ae.jpg)