No Par Value Bearer Shares Meaning

2 770 117 shares central pacific financial corp.

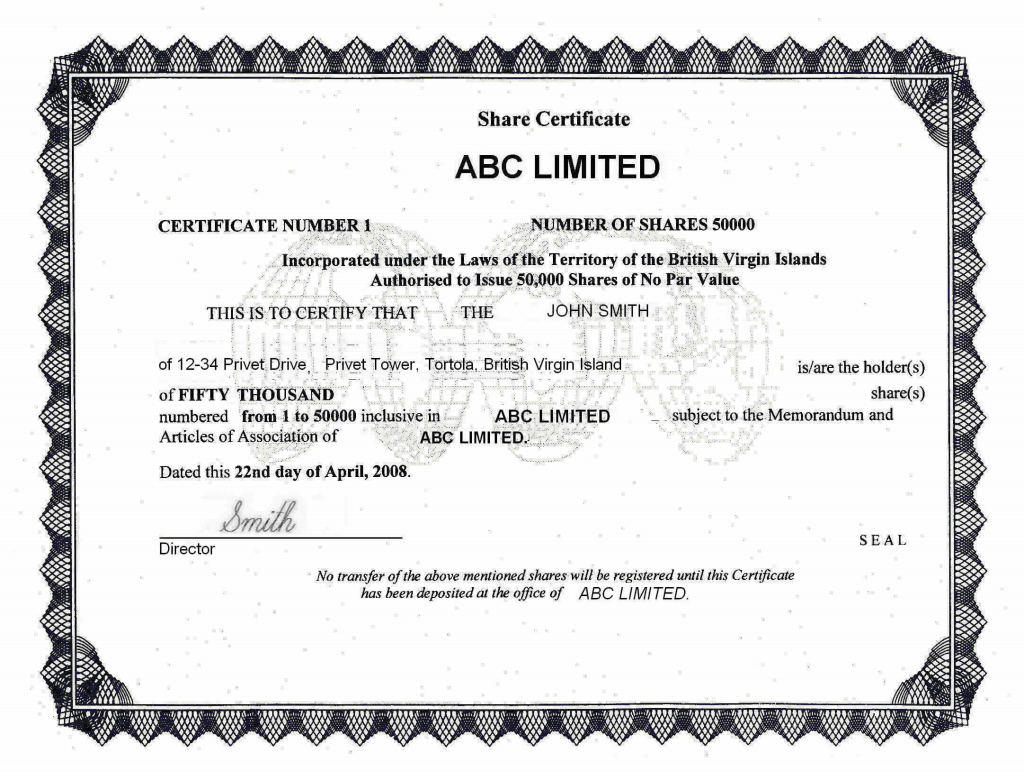

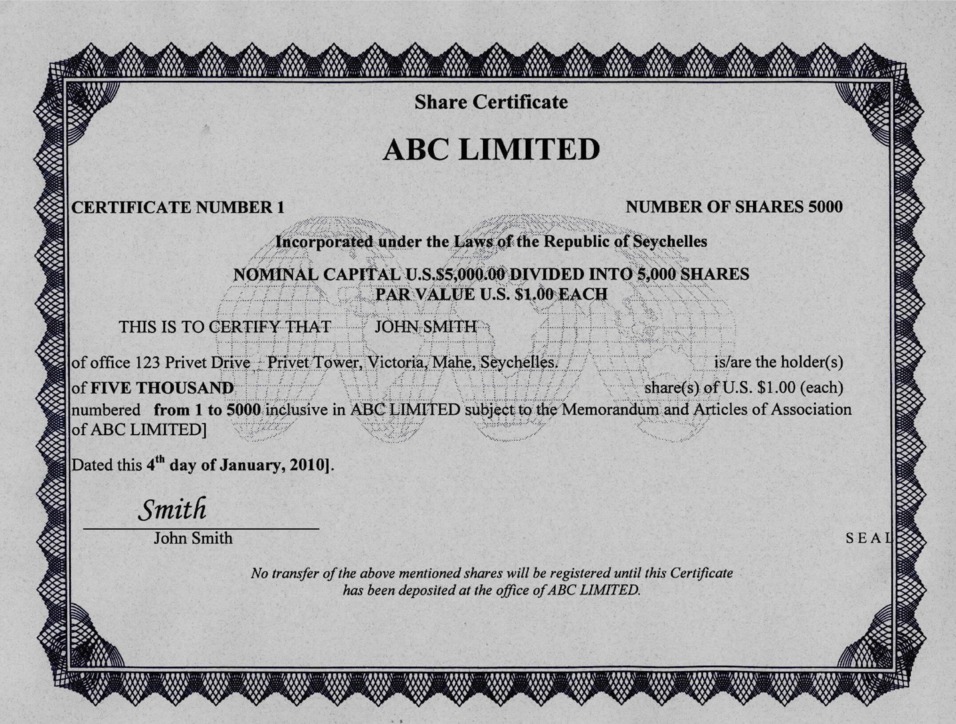

No par value bearer shares meaning. Common stock no par value per share underwriting agreement march 29 2012 sandler o neill partners l p 1251 avenue of the americas 6th floor new york new york 10020 ladies and gentlemen. The number of shares of each class which a no par value company is authorised to issue is stated in the. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares. No par stocks have no par value printed on their certificates.

Exchangeable into no par value ordinary bearer shares of covestro ag isin. A no par value company issues shares which are not expressed as having a nominal value. Central pacific financial corp a hawaii corporation the company has issued to the. A no par value stock is issued without the specification of a par value indicated in the company s articles of incorporation or on the stock certificate itself.

Par value stock. For example if a corporation issues 100 new shares of its common stock for a total of 2 000 and the stock s par value is 1 per share the accounting entry is a debit to cash for 2 000 and a credit to common stock par 100 and a credit to paid in capital in excess of par for 1 900. 2 225 000 by issuing up to 2 225 000 new no par value bearer shares in exchange for cash and or non cash contributions authorised capital the executive board is authorised to determine the further content of the equity rights and the terms and conditions of the issue of these shares subject to the approval of the supervisory board the new shares must be offered to the company s shareholders. States allow no par stocks to have a stated value set by the board of directors of the corporation which serves the same purpose as par value in setting the minimum legal capital that the corporation must have after paying any dividends or buying back its stock.

On the issue of shares of a no par value company the proceeds whether in the form of cash or otherwise will be credited to a stated capital account. Instead of par value some u s. There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the. Share issued with no par value specified either on the share certificate or in the issuer firm s charter or prospectus.

The objectives of its issuance include 1 avoidance of taxes levied according to the share s face value 2 avoidance of the issuer firm s liability to shareholders in the event the shares have to.

/GettyImages-1058454392-146fd62a8b20476fa0888ecfa18868ae.jpg)

:max_bytes(150000):strip_icc()/ppl_brown__63765.1548538982.1280.1280-7a4e78e7b4314bda9bac6c7c60604f3f.jpg)