No Par Value Accounting

However par value is now usually set at a minimal amount such as 0 01 per share since some state laws still require that a company cannot.

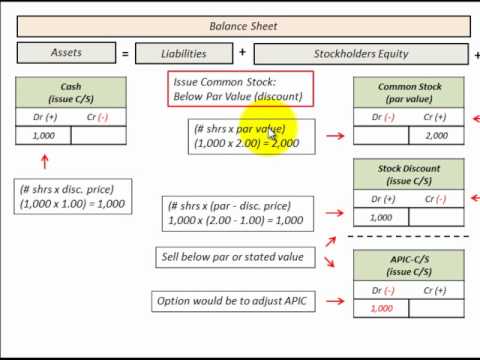

No par value accounting. There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the. What is par value of share. A par value stock unlike a no par value stock has a minimum value per share set by the company that issues it. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value.

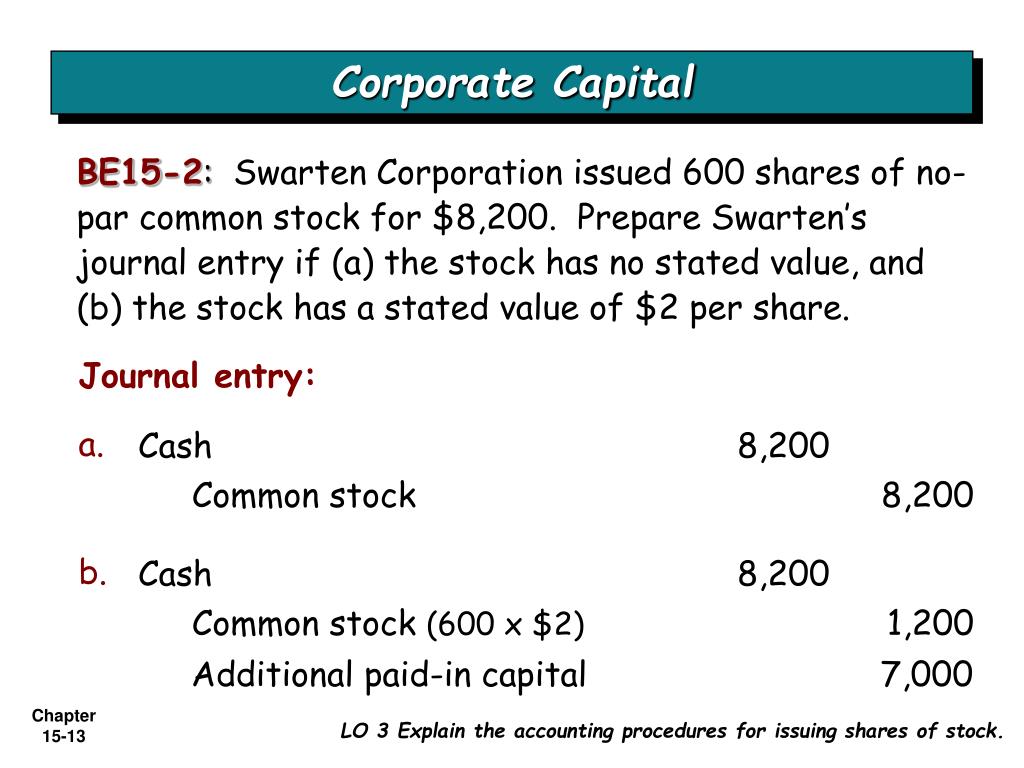

Other states might not require corporations to issue stock with a par value. Par value is the stock price stated in a corporation s charter. Normally when a business is incorporated the corporate charter assigns a par value or base value for every share that will be issued. No par stock is stock issued without a par value.

In the past companies issued shares with significant par values such as 10 00 per share leading to confusion between this arbitrarily assigned amount and the actual market value of the shares with which it has no link. This has no relevance to the value of either in the market. So the par value on common stock is a legal consideration. Although prohibited in many countries the issuance of no par value stock is allowed in some states of usa.

No par value stock sometimes called no par stock is a class of stock that was never assigned a par value or stated value. The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value. The par value on common stock has generally been a very small amount per share. Some states may require a corporation to have a par value while others states do not require a par value par value can also refer to an amount that appears on bond certificates in the case of common stock the par value per share is usually a very small amount such as 0 10 or 0 01 and it has no connection to the market value of the share of stock.

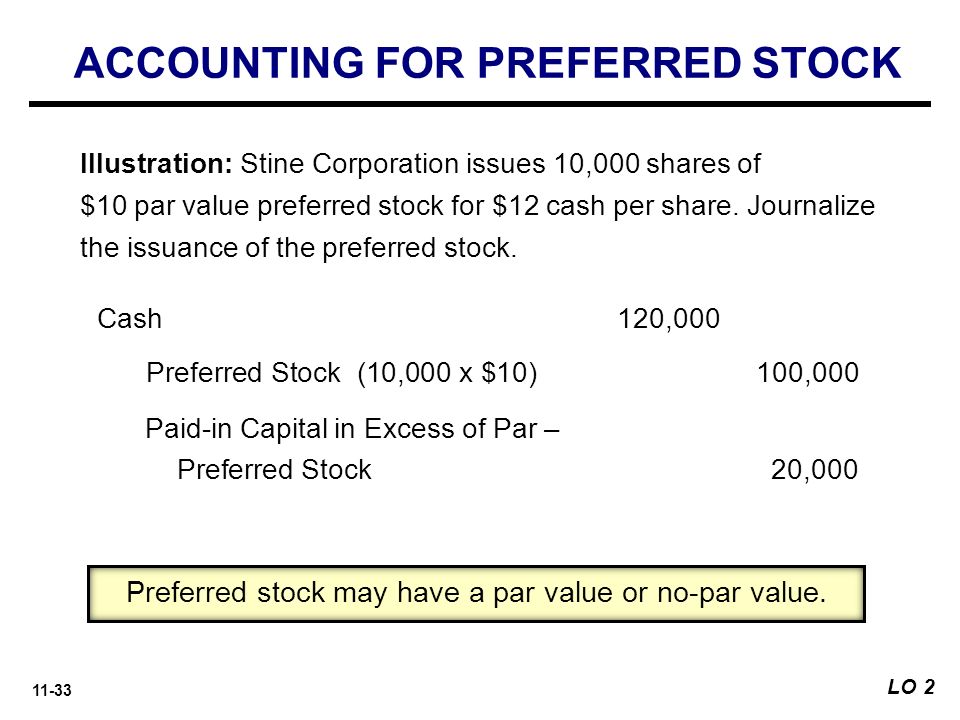

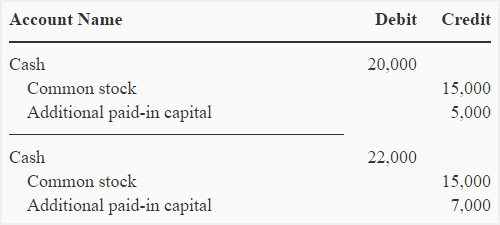

A no par value stock is issued without the specification of a par value indicated in the company s articles of incorporation or on the stock certificate itself. From an accounting standpoint the par value of an issued share of common stock must be recorded in an account separate from the. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. Par value for stock.

No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares.

/GettyImages-1058454392-146fd62a8b20476fa0888ecfa18868ae.jpg)